Performance – March 2022 (03/12)

Since the start of the year was not quite so positive, things finally picked up again in March 2022. The news is still dominated by war and inflation. But this all seems to be priced in the meantime and it is again diligently invested. I myself invest regularly and for the long term and would like to build up a nice dividend for my old age.

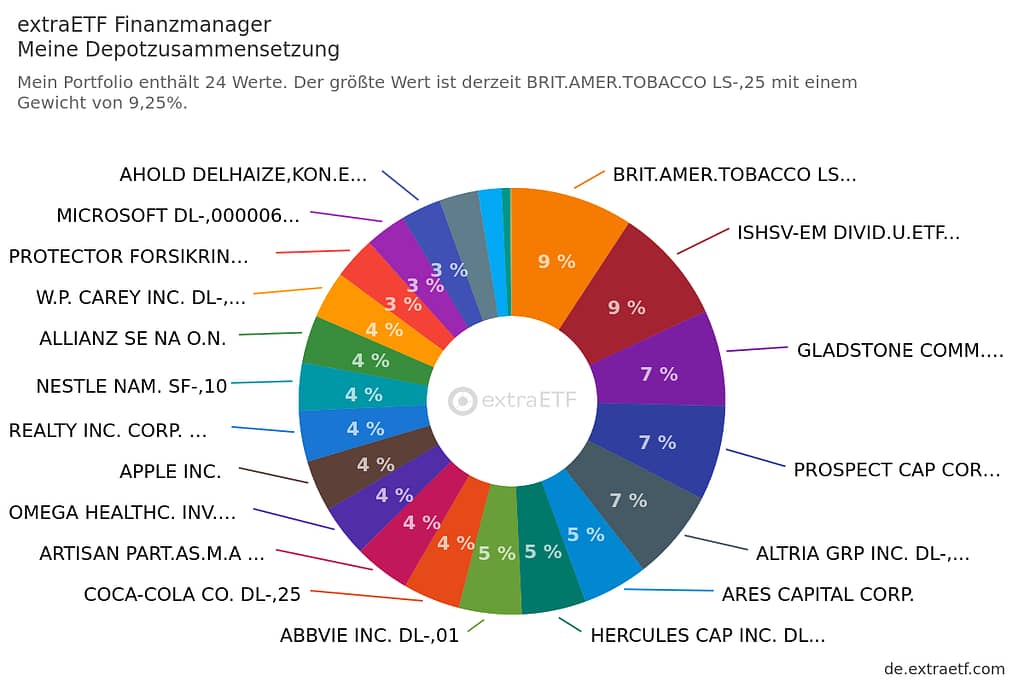

In March 2022, a lot happened in my dividend portfolio and there was a major sale. Of course, the savings plans on the Xtrackers Stoxx Global Select Dividend 100 Swap UCITS ETF – 1D EUR DIS with 200 euros (LU0292096186) and the iShares EM Dividend UCITS ETF – USD DIS 50 euros (IE00B652H904) were running normally. In the meantime, I am also investing in the Deut. Börse Commodities GmbH Xetra-Gold IHS 2007(09/Und) (DE000A0S9GB0) with 50 Euro per month. I have now also added some crypto. Via Coinbase I am now also saving Etherum and Bitcoin at 25 Euro each (50 Euro total). My monthly savings rate is therefore 350 euros per month.

With gold and crypto, I would like to diversify a bit more here and bring new asset classes into my portfolio. Otherwise, I did not invest any additional money here in March, as a larger sum was already invested in February. In total, I had invested a strong 6,550.48 euros in February 2022 and have already come very close to my actual investment goal for 2022.

As a goal for 2022 I had planned to invest at least 9,600 euros, which would be an average of 800 euros per month. Since the start of the year went very well, I have now invested just over 8,000 euros as of March 2022. I am very happy about that, that I can really invest like that. The goal is still for me to continue to grow the dividends. In the first quarter, there were almost 700 euros in dividends and I am therefore on a very good path. Compared to the previous year, there were significant increases here. In March there was a total of 327.48 euros in dividends. You can read the exact list here. You can follow the exact overview of my dividends on my monthly dividend overview page.

In March I sold one ETF, the GLOBAL X SUPERINCOME PREFERRED ETF (US37950E3339). Unfortunately, I could not continue to buy this ETF from Smartbroker and thus could not continue to grow this position. Therefore, I decided to sell, which was still executed. With this money I have then stocks such as Altria, Artisan Partners, Prospect Capital and Protector Forsikring further increased.

All in all, I continue to invest diligently and am delighted every time to see how the dividends develop. If I really keep this up for 20 years or more, I should be able to build up a nice additional passive income.

Performance March 2022

But now let’s get to the actual performance of my dividend portfolio for March 2022. This time there was again a positive performance to report and my portfolio continues to perform positively overall.

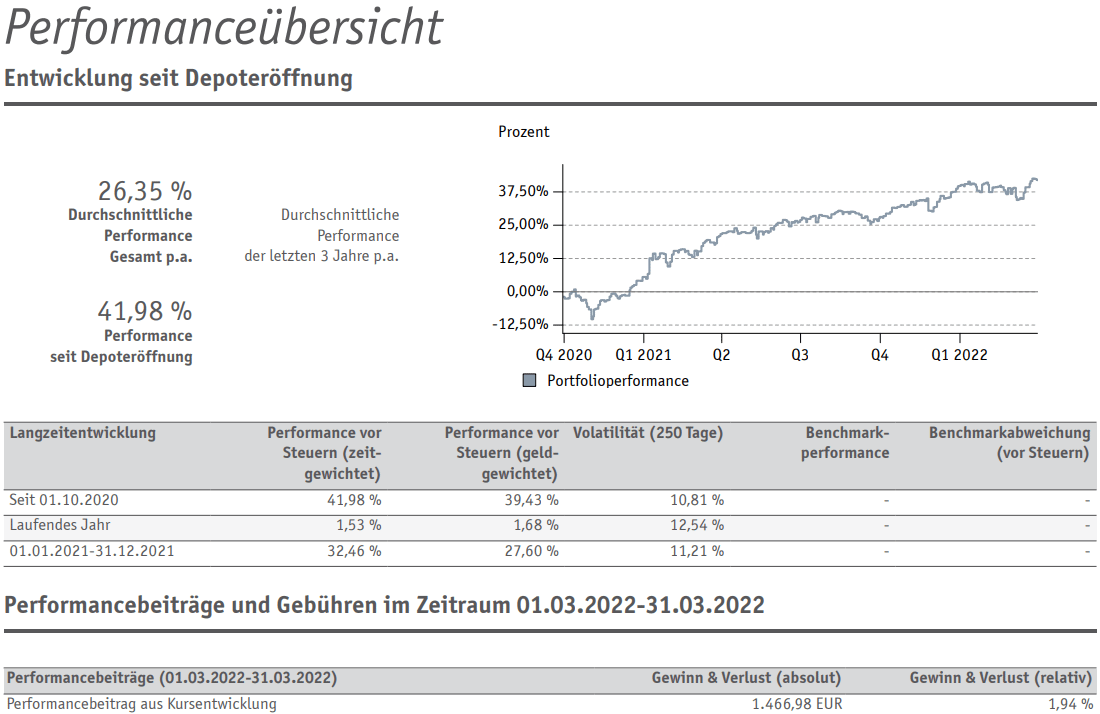

My dividend portfolio went up this time by +1.94%, which equals +1,466.98 euros in total. The overall performance has thus risen again to a very good 41.98%. This development is very positive and I am very pleased with this overall performance and will continue to stick to my strategy.

Below again the extract from my broker „Smartbroker“ (extract created on 17.04.2022):

Top 5 winners and losers March 2022

Let’s get back to the TOP 5 winners and losers in my dividend portfolio:

| Gewinner | Verlierer | ||

| Protector Forsikring | 14,89% |

Unilever |

05,53% |

| Omega Healthcare | 13,96% |

British American Tobacco |

01,79% |

|

AbbVie |

11,00% |

iShare EM Dividende ETF |

01,35% |

|

Allianz |

10,67% |

Ares Capital |

00,34% |

|

Apple |

09,15% | Altria Group | 00,13% |

Overall, there was a decent upward trend again. Insurance companies such as Protector Forsekring and Allianz have risen well. Omega Healthcare has also risen again and it will be interesting to see whether this share can keep this up. Apple seems to know only one direction anyway and AbbVie also seems to be slowly taking off.

The losers are led by Unilever, which is not really surprising. BAT has weakened a bit after the recent very good rise in prices. The ETF is of course down a bit due to the war, but will still remain a component of my portfolio.

Dividends March 2022

You can read the detailed overview of my dividends in March 2022 in the article „Dividend Income – March 2022 (03/12)„. In total, there were 327.48 euros in dividend income to report this time.

Sales

Complete sale GLOBAL X SUPERINCOME PREFERRED ETF (US37950E3339).

Buys

As described above, there were .some purchases to report this month. Therefore, below is a brief list of what I bought:

- Prospect Capital (US74348T1025)

- Xtrackers Stoxx Global Select Dividend 100 Swap UCITS ETF (LU0292096186)

- iShares EM Dividend (IE00B652H904)

- Deut. Börse Commodities GmbH Xetra-Gold IHS 2007(09/Und)

- Altria Group (US02209S1033)

- Artisan Partners (US04316A1088)

- Protector Forsikring (NO0010209331)

- Bitcoin

- Etherum

Conclusion

Overall, the positive development continues and the dividends are also developing very positively. I will continue to invest here diligently and of course regularly. The goal is still to increase the dividends and thus be able to further increase the investments.

How has your portfolio developed?

Kind regards,

Mario

Performance – November 2022 (11/12) & Dezember 2022 (12/12)

Wie hat sich mein Dividenden-Portfolio im November und Dezember 2022 entwickelt? Wie haben sich einzelne Aktien entwickelt?

Performance – Oktober 2022 (10/12)

Wie hat sich mein Dividenden-Portfolio im Oktober 2022 entwickelt? Wie haben sich einzelne Aktien entwickelt? Gibt es auch positives zu berichten?

Performance – September 2022 (09/12)

AktienDummy.de | 17.10.2022 | Performance | Mario Performance - September 2022 (09/12) Wie hat sich mein Dividenden-Portfolio im September2022 entwickelt? Wie haben sich einzelne Aktien entwickelt? Gibt es auch positives zu berichten? Alle Fragen...

0 Comments