Performance – February 2022 (02/12)

The news is currently dominated by only one topic. I also find it terrible what is happening. However, this is not a political site and I would therefore not like to go into this topic here. We can all only hope that it is over quickly and the suffering finally has an end. At this point, I would like to show my performance in the depot and thus let you continue to participate in the development.

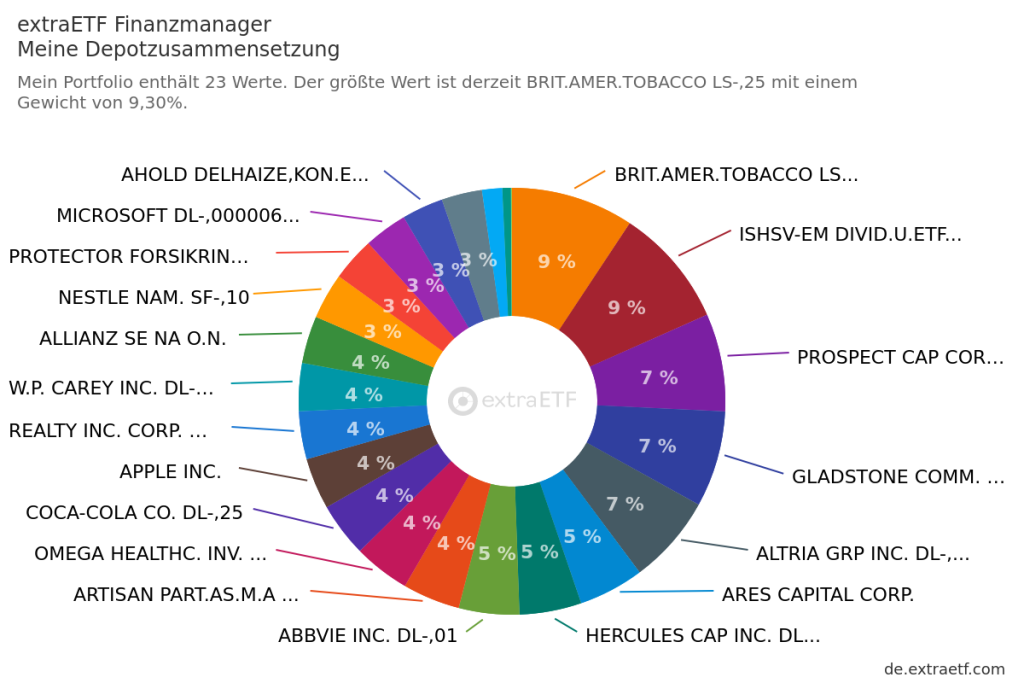

In February 2022, a lot has happened in my dividend portfolio. Of course, the savings plans on the Xtrackers Stoxx Global Select Dividend 100 Swap UCITS ETF – 1D EUR DIS with 199.20 euros (LU0292096186) and the iShares EM Dividend UCITS ETF – USD DIS 49.20 euros (IE00B652H904) ran normally. The numbers are a bit crooked, as there are 0.80 euros in fees for each here at Smartbroker. Attentive readers will have noticed that the savings rate for the EM ETF has decreased. This ETF has now grown to such an extent that I put on the brakes a little here. Other stocks should first catch up a bit, so that the allocation fits again.

Furthermore, I have Prospect Capital (US74348T1025) with 1002.16 euros further stocked up to be able to further increase the monthly dividend here. New to my dividend portfolio is Altria (US02209S1033) and here I have invested in February a total of 2,171.88 euros. This is to improve the weak dividend months such as January something.

As a further new title Artisan Partners (US04316A1088) has made it into the depot. Here I have struck for altogether 2127 euro. And still another title I have newly acquired and namely Protector Forsikring (NO0010209331) for a total of 1001.04 euros.

In total, I have invested a strong 6,550.48 euros in February 2022. This is not due to the current circumstances in the world. I got here my annual bonus for 2021 paid by my employer and thus the investment was already planned before the Ukraine crisis. Of course, the entry prices were then a lot better as a result, but this is only secondary in view of the current news.

All these purchases are intended to further increase my dividends and further diversify the portfolio. I see myself on a good path here and this is also shown to me by the dividends and their general growth in my portfolio again and again.

In February 2022, there were exactly 266.60 euros in dividends to report. The exact overview of my dividends can be read here in the article “Dividend Income – February 2022 (02/12)” or follow on my dividend overview page monthly update.

So I always continue to invest diligently and look forward every time anew, how the dividends develop. If I really keep this up for 20 years and more, I should be able to build up a nice additional passive income.

Performance February 2022

But now let’s look at the actual performance of my dividend portfolio for February 2022. As with many investors, the performance continued to go down this month, but that’s just part of the game with such investments. It can not always just rise and rise. That would be too easy.

My dividend portfolio has also been hit this time and it went -2.86% or -2026.56 euros down. The overall performance has thus dropped to a still very good 38.11%. This development is not really dramatic and is rather a small correction. I am satisfied with this overall performance and will continue to stick to my strategy.

Below again the extract from my broker “Smartbroker” (extract created on 13.03.2022):

Top 5 winners and losers February 2022

Let’s get back to the TOP 5 winners and losers in my dividend portfolio:

| Winners | Loosers | ||

| AbbVie | 08,48% |

Allianz |

10,90% |

| Coca-Cola | 03,83% |

Omega Healthcare |

09,51% |

|

Altria Group |

03,15% |

iShare EM Dividende ETF |

08,95% |

|

BAT |

02,48% |

Gladstone Commercial |

07,62% |

|

Artisan Partners |

01,70% | Prospect Capital | 05,41% |

There are no real surprises among the winners. AbbVie has been rising for quite a while. Tobacco stocks are also currently on an upward trend. Coca-Cola has always been so stable and may well remain so. Artisan Partners I just caught a good entry.

The losers are not really surprising either. The EM Dividend ETF is going down because of the current situation and Russian stocks are probably going to be cut here as well. Financials are generally down right now and Omega Healthcare is “as usual.” In the long term, however, I don’t see any problems here and all stocks will also recover.

Dividends February 2022

You can read the detailed overview of my dividends in February 2022 in the article “Dividend Income – February 2022 (02/12)“. This time there was a total of 266.60 euros in dividend income to report.

Sales

There were no sales in February 2022.

Buys

As described above, there were .some purchases to report this month. Therefore, below is a brief list of what I bought:

- Buy Prospect Capital (US74348T1025)

- Buy Xtrackers Stoxx Global Select Dividend 100 Swap UCITS ETF (LU0292096186)

- Buy iShares EM Dividend (IE00B652H904)

- Buy Altria Group (US02209S1033)

- Buy Artisan Partners (US04316A1088)

- Buy Protector Forsikring (NO0010209331)

Conclusion

Overall, the positive development continues and the dividends are also developing very positively. I will continue to invest here diligently and of course regularly. The goal is still to increase the dividends and thus be able to further increase the investments.

How has your portfolio developed?

Kind regards,

Mario

STEG Electronic melden Konkurs an – Anfang der Rezession

Der digitale Markt ist ständig in Bewegung, aber was, wenn einer der bekanntesten Online-Shops plötzlich Konkurs anmeldet? Lassen Sie uns den Fall von STEG Electronics und seinen Partnern genauer betrachten. Was ist passiert? Am 8. September brach in der E-Commerce-Welt der Schweiz ein Sturm los. STEG Electronics, Techmania und ihre Partner gingen pleite. Dies sind…

Read more

Der Beitrag STEG Electronic melden Konkurs an – Anfang der Rezession erschien zuerst auf Sparkojote.

Shopware: Funktionen für B2B-Kunden im Überblick

In der zunehmend digitalen Welt sind E-Commerce-Plattformen von entscheidender Bedeutung, um den Bedürfnissen der eigenen Kunden gerecht zu werden. Dies gilt auch für B2B-Unternehmen. Eine Plattform aus dem B2B-Bereich, die in den letzten Jahren viel Aufmerksamkeit...

Alarmstufe Rot! BILD berichtet über NVIDIA – Zeichen für die Dienstmädchen-Hausse? ?

NVIDIA – das Unternehmen, das in aller Munde ist NVIDIA hat wieder Schlagzeilen gemacht. Nicht nur in Fachmedien, sondern auch bei der BILD. Normalerweise ist es ja nicht üblich, dass Aktien so im Fokus stehen. Doch mit NVIDIA sieht es derzeit anders aus. Beeindruckende Quartalszahlen NVIDIA konnte seinen Gewinn um das Zehnfache steigern, und das…

Read more

Der Beitrag Alarmstufe Rot! BILD berichtet über NVIDIA – Zeichen für die Dienstmädchen-Hausse? ? erschien zuerst auf Sparkojote.

0 Comments