Performance – April (04/12)

The stock markets are currently very volatile. Most portfolios will probably only know one direction at the moment, and that is down. My dividend portfolio also went into the red this month. However, this “correction” can even be an opportunity for long-term investing, as the entry prices are so much more favorable. Currently, in my view, there are many good buying opportunities and too little available capital. How exactly my dividend portfolio has now developed in April 2022, you can read here.

The war in Ukraine is still going on, and the first increases in key interest rates have now also taken place. In addition, there is still very high inflation and the stock market is already going down. Whereby with some shares this is rather a correction in my eyes. Many shares were simply so far risen and thus overvalued. Therefore, one could almost speak of a correction here. For long-term investors, like me, this correction in the stock markets can also be another buying opportunity. Here possibly still one or two weeks wait and then invest again nicely. However, I have at the moment rather the problem that for re-buying now not so much capital is available. So at the moment many buying opportunities and little capital.

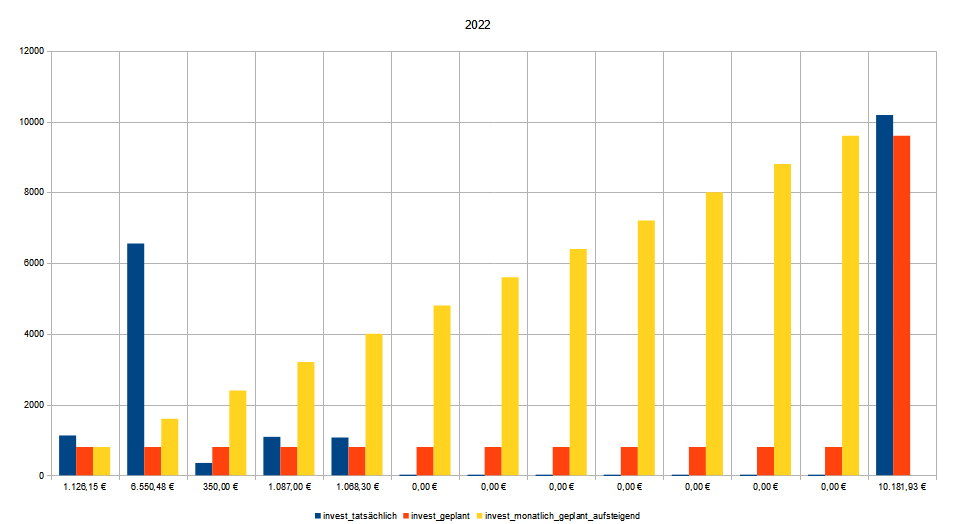

But I will continue to invest regularly through my fixed savings plans and also always invest capital, which is left at the end of the month. In April 2022, I have invested 1,087.90 euros here. Meanwhile, I have already exceeded my annual goal of planned 9,600 euros minimum in 2022. Currently, I have already invested 10,181.90 euros in this dividend portfolio this year and this is somehow still incomprehensible to me. From this point of view, I am doing very well financially and I continue to try to invest here regularly.

The regular investing has already made itself very well felt with me. I see this again and again in the development of my dividends and this development is more than positive for me. In April 2022 there were beautiful 420.71 euros in dividends to record, which is a new record for me. In April 2021, there were just 57.72 euros in dividends. So here you can see very nicely how regular investing can have an effect. All dividends received are reinvested again and again and thus my future investments increase almost by themselves. So the “snowball” is slowly starting to roll.

What happened in my stock portfolio in April 2022?

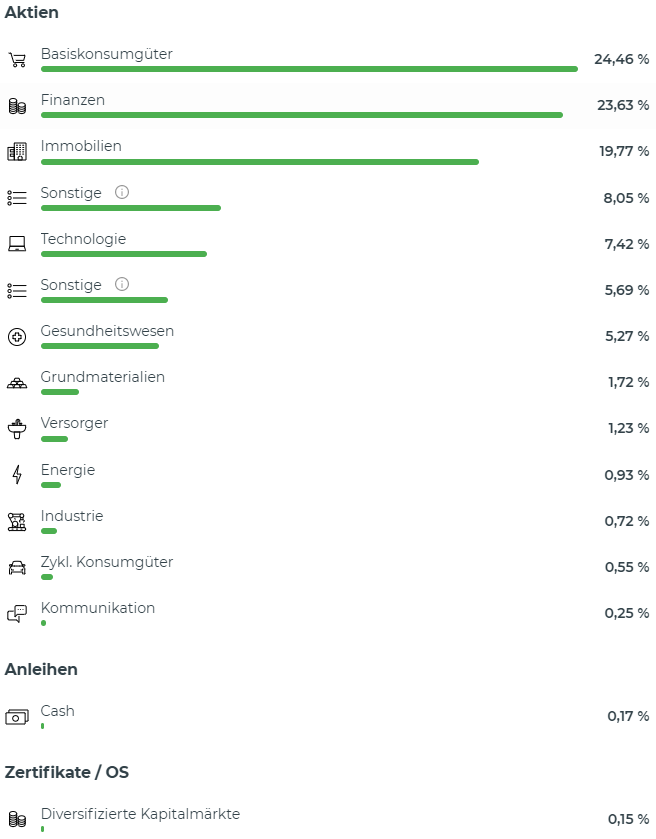

As usual, there were the savings plans with 200 euros in the Xtrackers Stoxx Global Select Dividend 100 Swap UCITS ETF – 1D EUR DIS (LU0292096186) and 50 euros in the iShares EM Dividend UCITS ETF – USD DIS (IE00B652H904). Furthermore, per savings plan 50 euros in Deut. Börse Commodities GmbH Xetra-Gold IHS 2007(09/Und) (DE000A0S9GB0) and 25 euros each in Etherum and Bitcoin.

This month two stocks left my portfolio: Nestlé and Unilever. With Nestlé was the decision for me, because of taxes. So there is not so much left of the dividends here. The effort to get the taxes back in Switzerland is too big for me personally and is not really worth it because of a Swiss company. I got out of Unilever for the time being, because I don’t really like the current management, which was also evident in the last takeover attempt. There will probably be no real growth here for the time being, unless the company raises prices.

In order to be able to further increase the dividends, I have added the DIVIDEND GROWTH SPLIT (CA25537Y1043) to my portfolio. This is of course a bit more risky, but worth investing in for me as an admixture. Now in May 2022 should be the first payment of dividends and I’m curious to see how it develops here. My personal dividend yield here is currently 16.16%. So not for the faint of heart.

Not much more has happened in my dividend portfolio. I rather focus on dividends and am not so keen on growth. So you can call me a kind of “income investor”. As long as my portfolio remains stable or even grows slowly, I am still very satisfied with appropriate dividend payments.

Performance April 2022

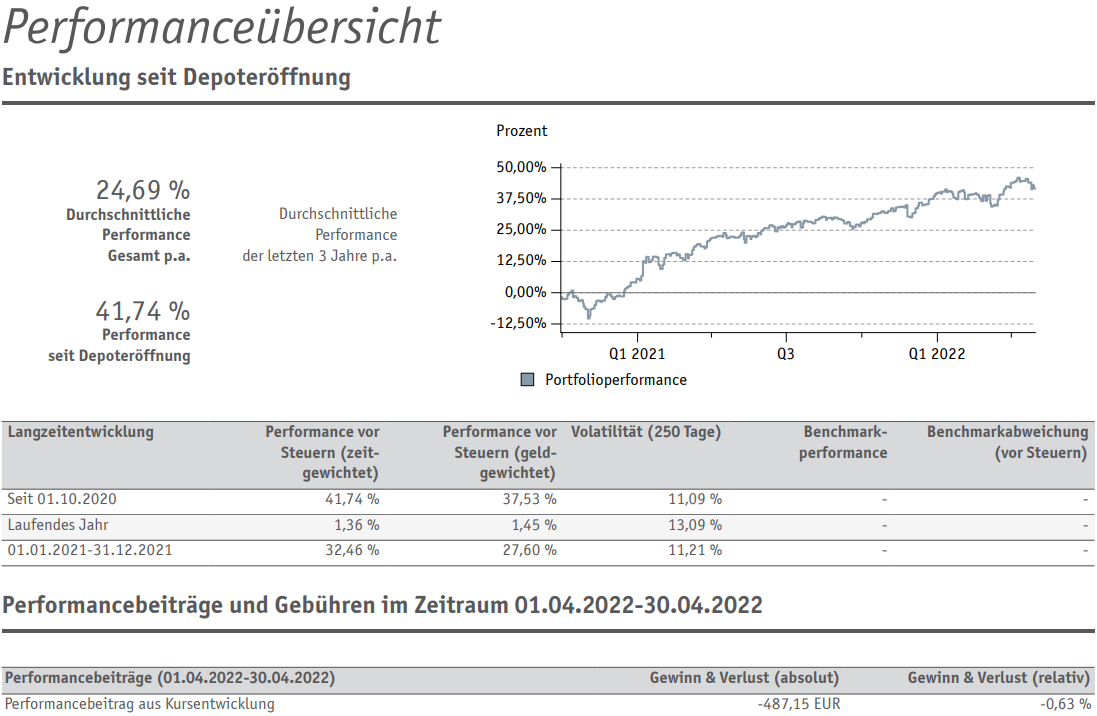

Now let’s get to the actual performance of my dividend portfolio. For me, too, it went downhill a bit in April. But the loss is less than I thought (felt).

The performance in April 2022 was -0.63% or -487.15 euros. I would have thought that there was much more loss in April. Here, however, I can already say that it goes in May then even further down. So seen, it is but still very well run. I have read here other blogs and watched videos and there it looked but with many much worse than with me. The performance since opening the depot is still very good +41.74% and for this year the performance is very good +24.69%. So for me everything is in the green and the overall development is still positive.

So always continue to invest diligently and above all regularly. This is very important for myself that I really stay on the ball here and keep increasing the dividends. The dividends are to achieve me once a passive income, without which I have to sell any shares here.

Top 5 winners and losers April 2022

Let’s get back to the TOP 5 winners and losers in my dividend portfolio:

| Gewinner | Verlierer | ||

| Altria Group | 11,34% |

Omega Healthcare |

15,33% |

| Coca-Cola | 08,77% |

Protector Forsikring |

13,60% |

|

W.P. Carey |

04,81% |

Artisan Partners |

12,73% |

|

Realty Income |

04,40% |

Xtrackers Stoxx Global |

05,79% |

|

Ares Capital |

04,22% | Microsoft | 05,51% |

Among the winners in April, I was somewhat surprised that REITs and BDCs benefited here. Due to the new key interest rates in the U.S., I expected something different here.

Among the losers, there was not really a big surprise, since I expected exactly this development in insurance and financial companies. Omega Healthcare did poorly again, as there are still payment difficulties with some customers. However, OHI should pick up again in May, as the quarterly figures were very positive in this difficult environment. Tech values have generally fallen and therefore a small correction in Microsoft. The company itself is core healthy and continues to deliver good figures.

Dividends April 2022

You can read the detailed overview of my dividends in April 2022 in the article “Dividend Income – April 2022 (04/12)“. In total, there were 420.71 euros in dividend income to report this time.

Sells

- Nestlé (CH0038863350)

- Unilever (GB00B10RZP78)

Buys

- Xtrackers Stoxx Global Select Dividend 100 Swap UCITS ETF (LU0292096186)

- iShares EM Dividend (IE00B652H904)

- Deut. Börse Commodities GmbH Xetra-Gold IHS 2007(09/Und)

- DIVIDEND GROWTH SPLIT (CA25537Y1043)

- Bitcoin

- Etherum

Conclusion

Overall, the positive development continues. The dividends are developing very positively and I hope that I can continue to invest in this way. In any case, I will continue to invest diligently and of course regularly. The goal is still to increase the dividends and thus be able to further increase the investments.

How has your portfolio been performing?

Kind regards,

Mario

STEG Electronic melden Konkurs an – Anfang der Rezession

Der digitale Markt ist ständig in Bewegung, aber was, wenn einer der bekanntesten Online-Shops plötzlich Konkurs anmeldet? Lassen Sie uns den Fall von STEG Electronics und seinen Partnern genauer betrachten. Was ist passiert? Am 8. September brach in der E-Commerce-Welt der Schweiz ein Sturm los. STEG Electronics, Techmania und ihre Partner gingen pleite. Dies sind…

Read more

Der Beitrag STEG Electronic melden Konkurs an – Anfang der Rezession erschien zuerst auf Sparkojote.

Shopware: Funktionen für B2B-Kunden im Überblick

In der zunehmend digitalen Welt sind E-Commerce-Plattformen von entscheidender Bedeutung, um den Bedürfnissen der eigenen Kunden gerecht zu werden. Dies gilt auch für B2B-Unternehmen. Eine Plattform aus dem B2B-Bereich, die in den letzten Jahren viel Aufmerksamkeit...

Alarmstufe Rot! BILD berichtet über NVIDIA – Zeichen für die Dienstmädchen-Hausse? ?

NVIDIA – das Unternehmen, das in aller Munde ist NVIDIA hat wieder Schlagzeilen gemacht. Nicht nur in Fachmedien, sondern auch bei der BILD. Normalerweise ist es ja nicht üblich, dass Aktien so im Fokus stehen. Doch mit NVIDIA sieht es derzeit anders aus. Beeindruckende Quartalszahlen NVIDIA konnte seinen Gewinn um das Zehnfache steigern, und das…

Read more

Der Beitrag Alarmstufe Rot! BILD berichtet über NVIDIA – Zeichen für die Dienstmädchen-Hausse? ? erschien zuerst auf Sparkojote.

0 Comments