AktienDummy.de | 2022-06-14 | My Portfolio | Mario

My monthly payers

In this article I would like to give you a closer look at my dividend portfolio and present my monthly payers in more detail.

Have fun when reading.

Monthly dividend payers in my portfolio

My portfolio is currently fully focused on passive income through dividends. For this purpose, I have changed some things in the past months. What I have done exactly when and how, you can follow up monthly on the page “Activities“.

Of course I publish my dividends here on AktienDummy.de every month. Therefore you can find a monthly overview of my dividends in the “Blog“. Furthermore you can see some statistics about my income on the page “Dividends” and there are all dividends nicely listed and summarized.

You can also see my dividend portfolio itself always up to date. On the page “Portfolio” all stocks, ETFs etc. are shown. But I will work a little bit on the overview of my portfolio. I plan to show some statistics (e.g. allocation industry or sector, countries or regions, assets, etc.). I believe that this will make the insight into my dividend portfolio much more comprehensive, accurate and interesting for you.

Personally, I don’t like the fact that dividends are paid almost only once a year in Germany. Somehow the “waiting time” until a dividend is paid bothers me here. Therefore, companies from the USA or Canada are more interesting for me. Here, a dividend is usually paid to me every quarter or even every month. From this point of view, this is only a matter of opinion, since dividends are dividends, regardless of the intervals at which they are paid out to shareholders.

For me, however, it is much nicer when the dividends reach me at much shorter intervals. So it’s always nice to look at when several companies have transferred a dividend to me every month. As I said, it’s really just a mental thing. However, I feel quite comfortable and very happy when more than 10 companies have paid a dividend in one month.

For this reason, I also have some monthly payers in my dividend portfolio. These monthly payers come to a large extent from the area “REITs” and “BDCs“. The financial services currently have a share of just under 30% in my portfolio. This share is quite high and I would like to reduce this to about 20% in the coming months. The share of REITs in the overall portfolio is just under 20% and I want to keep it that way for the time being. I feel quite comfortable with these values.

In the following, I present you my monthly payers in more detail.

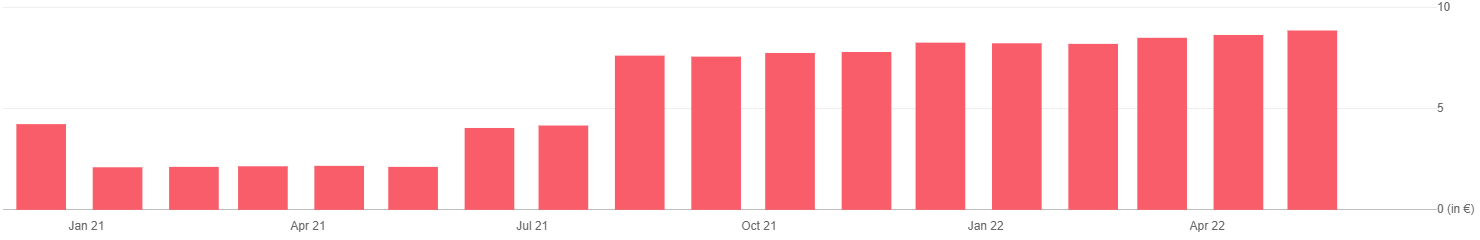

Realty Income

This is probably for many a very well-known REIT and this is also quite large. Realty Income invests primarily in shopping centers, mainly in the USA and Great Britain. The company was founded in 1969 and is a very reliable dividend payer. The company is headquartered in San Diego.

Why in my dividend portfolio?

Very large, well-known and successful REIT. Dividends come in regularly and are also increased regularly. A top-up is firmly planned for the future.

Details of the asset in my dividend portfolio

- WKN: 899744

- ISIN: US7561091049

- LAND: USA

- ASSET: Stock

- SHARES: 38

- IN DEPOT SINCE: 2020-11-05

- ALLOCATION: 3,53%

- PERSONAL DIVIDEND YIELD: 05,09%

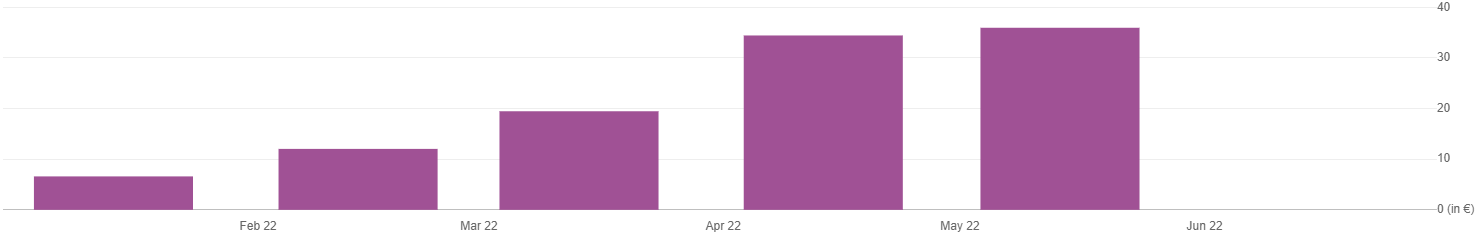

Prospect Capital

Prospect Capital is a BDC, which means that it belongs to the financial services sector. This BDC mainly invests its capital in medium-sized private companies, which are active in various industries. In the market since 2004 and headquartered in New York.

Why in my dividend portfolio?

This BDC is interesting to me because of its low P/E ratio. The dividend yield is also quite high and it pays regularly with no lapses. In the future I may buy more (allocation financial services should be reduced overall).

Details of the asset in my dividend portfolio

- WKN: A0B746

- ISIN: US74348T1025

- LAND: USA

- ASSET: Stock

- SHARES: 629

- IN DEPOT SINCE: 2021-12-20

- ALLOCATION: 6,74%

- PERSONAL DIVIDEND YIELD: 09,24%

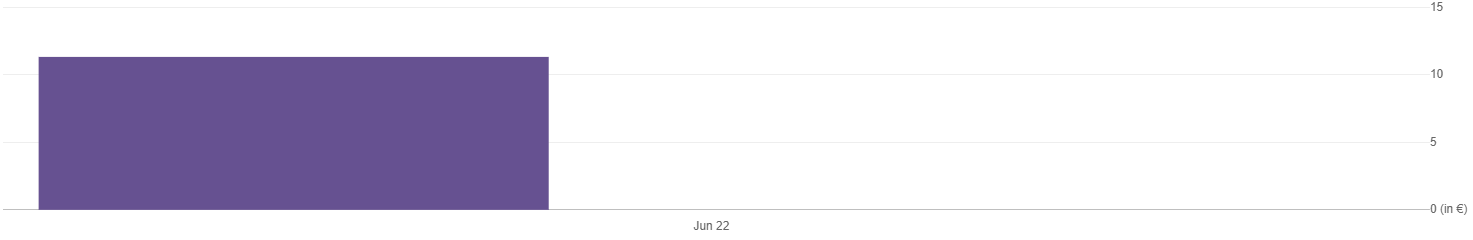

Gladstone Capital

Another BDC in my portfolio, Gladstone Capital belongs to the Gladstone family. This company mostly provides loans to various companies that may not have an outstanding credit rating and thus cannot always get bank loans directly. Gladstone Capital has been on the market since 2001 and the company is headquartered in McLean.

Why in my dividend portfolio?

While a comparatively small BDC, it also has a low P/E ratio. The dividend is quite high and is paid regularly. In the future, I can also imagine acquisitions here.

Details of the asset in my dividend portfolio

- WKN: 797937

- ISIN: US3765351008

- LAND: USA

- ASSET: Stock

- SHARES: 181

- IN DEPOT SINCE: 2022-05-17

- ALLOCATION: 2,74%

- PERSONAL DIVIDEND YIELD: 06,84%

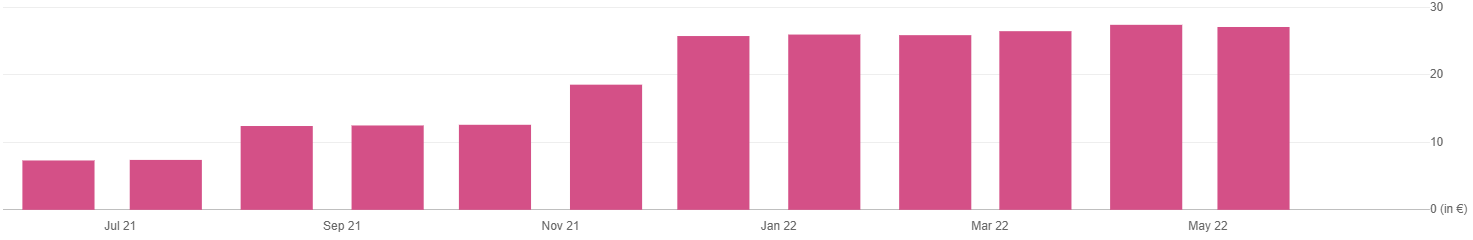

Gladstone Commercial

And another BDC from the Gladstone family. Gladstone Commercial is a classic REIT that specializes in commercial real estate. Mainly these properties are office space and also industrial properties. This REIT has been in the market since 2033 and the headquarters is located in McLean.

Why in my dividend portfolio?

This is a relatively small REIT, but it is very profitable and the dividend is right too. I can see myself making additional acquisitions here.

Details of the asset in my dividend portfolio

- WKN: 260884

- ISIN: US3765361080

- LAND: USA

- ASSET: Stock

- SHARES: 233

- IN DEPOT SINCE: 2021-05-21

- ALLOCATION: 6,33%

- PERSONAL DIVIDEND YIELD: 07,54%

Dividend Growth Split

Dividend Growth Split Corp. is a mutual fund company managed by Brompton Funds Limited. Brompton was founded in 2000 and the company is headquartered in Toronto.

Why in my dividend portfolio?

With the high dividend yield, yet a bit more risk than my other monthly payers. But for me a good addition for monthly dividends.

Details of the asset in my dividend portfolio

- WKN: A1C6X2

- ISIN: CA25537Y1043

- LAND: Canada

- ASSET: Stock

- SHARES: 1.033

- IN DEPOT SINCE: 2022-10-04

- ALLOCATION: 7,98%

- PERSONAL DIVIDEND YIELD: 16,37%

Unilever und Emerging Markets ETF Investitionen GESTOPPT!

Hast du dich jemals gefragt, wann und warum Anleger ihre Sparpläne ändern? Hier sind die Gründe, warum ich kürzlich einige meiner Sparpläne pausiert habe und wie ich mein Portfolio umstrukturiert habe. Änderungen in meinem Portfolio Zuerst einmal habe ich meine Unilever-Position pausiert, die immerhin 7% meines Yuh Depots ausmacht, und meinen monatlichen Beitrag zum iShares…

Read more

Der Beitrag Unilever und Emerging Markets ETF Investitionen GESTOPPT! erschien zuerst auf Sparkojote.

Hoch die Hände, Dividende! (September 2023)

Es wird Zeit für den Zwischenstand im September 2023. Bisher wurden es insgesamt rund 174 € und es stehen noch einige Zahlungen aus. In Parqet* sind noch ca. 300 € Dividenden für diesen Monat angekündigt und ich bin schon gespannt auf das Ergebnis. Im September 2022...

Atemberaubendes Wachstum im Quartalsvergleich

Bei einer Aktie, die ich bereits seit 15 Jahren im Depot habe und die seitdem nur gestiegen ist, denke ich bei den Quartalszahlen immer wieder, dass so ein stetiges Wachstum doch eigentlich nicht sein kann. Und im folgenden Quartal wächst dann doch alles weiter....

0 Comments